Personal Tax simplified: The revolutionary impact of automation

on 14 November 2023

Do you ever feel overwhelmed by Personal Tax tasks?

It's common to see client documents vanish into the depths of your inbox when using email, which means you might miss something important.

Plus, a disconnected Personal Tax process is probably leaving you a bit lost about your team's workflow too.

Gathering all the necessary documents and information from clients often feels like a relentless race against time and chasing them is impacting your efficiency.

If this issue isn't addressed, it can lead to significant stress, missed opportunities, and concerns about the accuracy of your tax returns.

It's also worth considering that your team might be quietly grappling with these challenges themselves, which could be affecting their morale and overall productivity.

How to identify the bottlenecks in your workflow

The issues you face, often start with a lack of urgency from clients in submitting their tax documents.

We all have experience chasing clients for their documents, time and again, feeling powerless and risking making a nuisance of ourselves by bombarding them with emails.

The sluggishness from clients not only delays the entire process but also, ironically, jeopardises the timing and quality of the service you provide to them.

You find that, rather than being able to analyse information and quickly get it submitted to HM Revenue & Customs (HMRC), you are continually chasing clients and trying to put together piecemeal information.

These delays lead to rushed submissions, which might overlook potential tax-saving opportunities for your clients.

It's a stressful situation that leads to a bottleneck in the workflow, with significant time wasted waiting for clients to get back to you.

Are you still using email to gather Personal Tax data? - You could be in trouble.

Compounding the workflow bottleneck issue is the method of communication you’re using.

Specifically, email, which is inefficient, to say the least.

Using email for document submission means you are constantly receiving fragmented information due to file size limitations and an inability to track the completeness of the documentation provided.

It’s frustrating for all of us and increases the risk of missing key documents and submitting tax returns with errors or non-compliance issues.

The limitations of email communication also mean that sensitive client information could be at risk, given the lack of encryption in standard email services.

On top of this, when the documents finally arrive, you face the painful process of manual data entry.

This is not only time-consuming but also introduces the significant risk of errors, which can multiply across different areas of the tax return, leading to a compounded effect of inaccuracies.

This can have serious repercussions for your clients and their compliance with tax regulations.

Poor tracking is hampering your workflow too!

When you don't have a good tracking system it's tough to keep an eye on how each tax return is doing or what stage your team is at in the process.

This means you're flying blind when it comes to managing Personal Tax.

It's hard to predict workloads or spot problems before they turn into bigger headaches.

This blurry view of what your team is up to and how they're handling their workflow can lead to mix-ups, not to mention time and effort going down the drain.

And without a clear picture of what's happening day-to-day, planning and sharing out tasks becomes more like making wild guesses than actually managing things smartly.

The effect on staff members and team morale

All these problems can knock the wind out of your team's sails, making them less happy at work and less productive.

This could make it harder to keep good staff at your firm and bring in new top-notch talent.

When the tax return process is out of sync, it's the same story with your team.

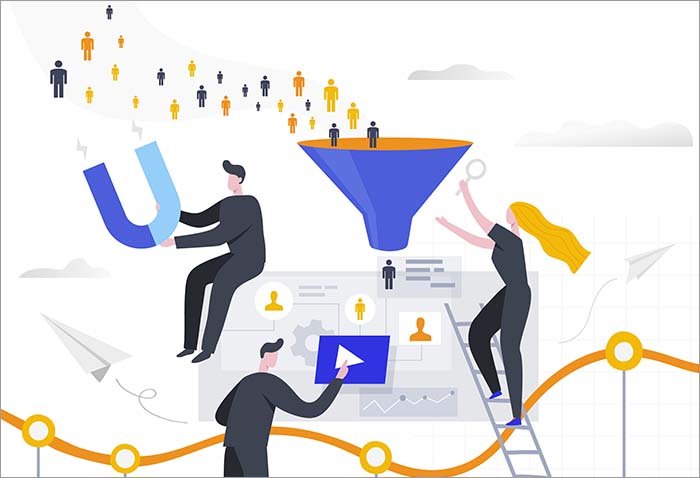

The problem simplified

A traditional Personal Tax process is a series of individual, disconnected steps rather than a streamlined, cohesive procedure.

The Personal Tax return problems you face are a result of not embracing automation and using digital management tools.

These tools and platforms could streamline your tax return process significantly and resolve all the issues mentioned above.

By failing to automate repetitive data entry tasks, you prevent your team from focusing on more complex, high-value aspects of tax planning and advice.

Find out how Glasscubes could automate your Personal Tax processes